How to Apply for PAN Card | Online PAN Card Apply in India 2023

PAN Card is a ten-digit unique alphanumeric number issued by the Income Tax Department. PAN card is basically in the form of a laminated plastic card.

PAN Card number is used to identify various taxpayers in the country.

Table of Contents

About PAN Card

PAN Card is a ten-digit unique alphanumeric & number, issued by Income Tax Department, now we discuss the structure of the ten characters of PAN.

Out of the first 5 characters, the first 3 characters represent the alphabetic series from AAA to ZZZ.

The fourth character of the PAN Card represents the status of the PAN Cardholder.

| P | for Individual |

| T | for Trust |

| F | for Firm/ Limited Liability Partnership |

| L | for Local Authority |

| J | for Artificial Juridical Person |

| G | for Government Agency |

| B | for Body of Individuals (BOI) |

| A | for Association of Persons (AOP) |

| H | for Hindu Undivided Family (HUF) |

| C | for Company |

The fifth character of the PAN Card represents in

- Individual

- PAN holder’s first character of last name or surname

- Non-individual

- PAN holder’s first character of the name

The next four characters (Numbers) are sequential numbers running from 0001 to 9999.

The last character OR tenth character is an alphabetic check digit.

Check out

How to Apply for PAN Card & Details

| PAN Card | Income Tax Department |

| Online applying details | Click here |

| Available for | Indian citizen / INR |

| Official website | Income tax |

| Apply for E-PAN | E-PAN |

| The online application can be made | NSDL or UTITSL |

PAN Card Application Fees

You can check by clicking Here

Type of PAN Card Applications

- Application for allotment of PAN

- FORM 49A

- FORM 49AA

- Application for new PAN Card/Changes/Correction in PAN data

How to Apply for an e-PAN Card

PAN Card application is also done online by following the steps given.

To apply for an e-PAN Card go to the official website.

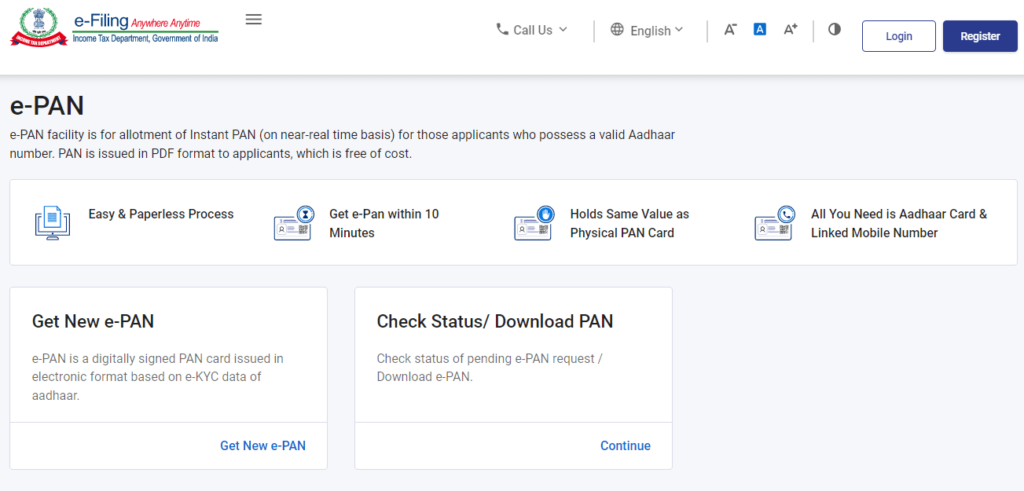

On this official website, where we have many choices but click on the Instant E-PAN.

After clicking on Instant E-PAN

Here we have two option

- Get a New e-PAN Card

- Check status / Download PAN Card

If you want to create a new PAN, then click on Get new e-PAN

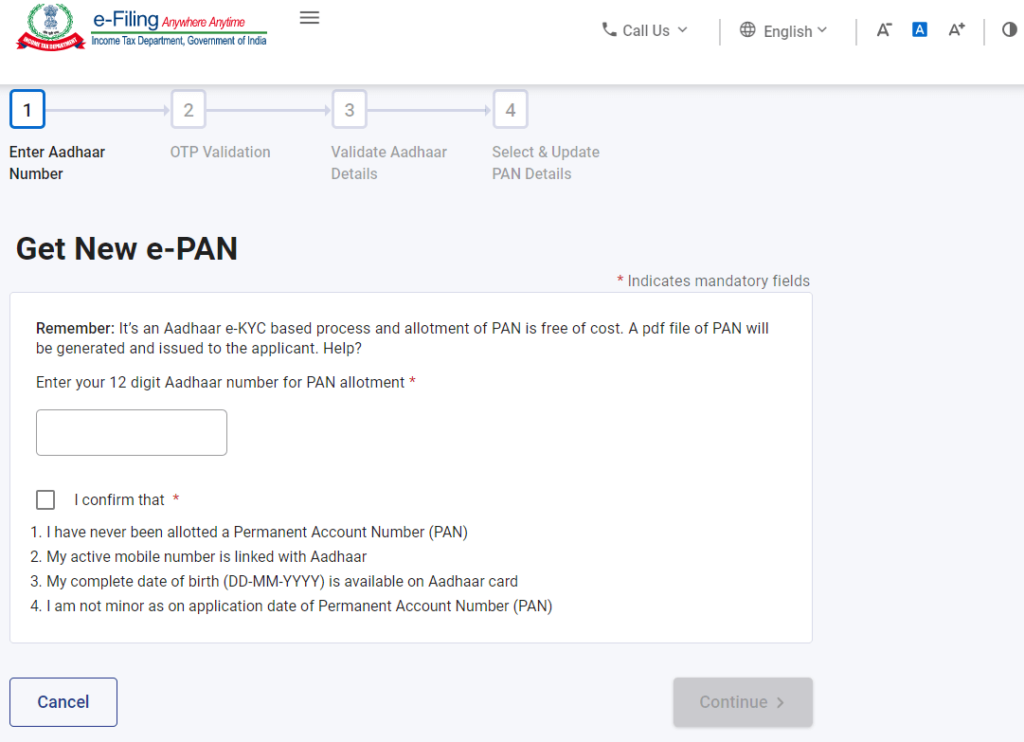

In this step, you enter the 12-digit Aadhaar number, and after that click on the check box and Continue.

After clicking the continue button, will get OTP on the Mobile number which is linked with Aadhaar Card.

Enter that OTP & click on that check box.

In this step, all your details (Name, DOB, Address) will show which is already linked with your Aadhaar Card.

Check whether all details are proper or not, if the details are clear then click on the check box & Continue.

After clicking continue, you will get a message Your request for an e-Pan Card has been submitted successfully.